Expat investments vary greatly from the options typically available to non-expats and, specifically, UK residents.

Expat investments options themselves can take many guises and for expats can be either onshore or offshore, although for expats, the offshore investment option is considered more favourable due to the tax benefits.

Similarly, some more traditional UK based investment options (such as ISAs) are not available for non-residents and expats living outside the UK.

Understanding all of the available investment options for expats can be complex and confusing which means it is important to get independent advice from a qualified adviser if you are unclear about your best course of action.

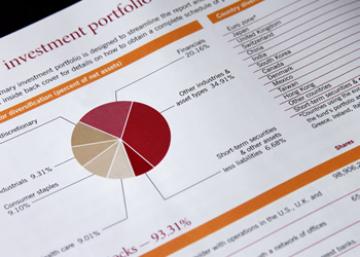

Many expats will opt for a mixture of investment products, often managed by a financial adviser or wealth manager.

Please do not rely purely on this article for making a decision, it has been designed as a guide only and your personal circumstances will affect which investment options are best for you.

We do offer a free investment consultation with an independent adviser from our network designed for expats both in the UK and abroad, regardless of your level of investment. Enter your details using the form to request your free consultation.

Expats and ISAs

For many UK residents, an ISA represents a relatively safe, convenient and tax efficient investment option.

Unfortunately, ISAs are only available for UK residents which means that if you live and work outside of the UK, and are not regarded as a UK resident you will be unable to open a new ISA or contribute any more to existing an ISA.

It is, of course, possible for an individual to hold an ISA before leaving the UK and, depending on the new country of residence, it is important to understand if the ISA would still be tax efficient in the new jurisdiction. For all expats holding ISAs it is sensible to explore potential options which could be more tax efficient in both the short and longer term.

Expat investments: Offshore investment bonds

An offshore investment bond is essentially a life insurance policy which acts as a tax wrapper containing a number of investment funds. While onshore bonds are available to UK residents, expats and non-UK residents have access to offshore bonds which are typically based on the Isle of Man, Jersey, Gibraltar and Guernsey – among others.

Offshore bonds provide a tax efficient investment option for expats as the bond will not be subject to capital gains tax and income tax deferred. This means that the investment grows free of tax, substantially increasing the value of the investment itself.

Even if the investor returns to the UK, the investment will continue to grow free of tax, providing the correct offshore bond is in place. For example, some highly personalised bonds can incur income tax as high as 45% on drawdown when the investor returns to the UK. For this reason it is vital to seek independent advice from someone who can analyse your full situation, including where you are likely to live in the future.

Any income taken from the bond will be subject to income tax according to the rules of the country of residence of the investor.

While investment bonds can offer some excellent advantages, it is important to understand the charges, fees and, potentially, commissions which will be charged.

The minimum investment for an offshore bond will depend greatly on the providers. The recommended provider will depend on a number of factors, including the level of control and diversification required, as well as the level of acceptable risk against an investment. In all cases, it is important to seek independent advice before making any decision on provider and investment amount.

The costs associated with investment bonds are likely to occur when the investment is originally made, while there is also likely to be an ongoing annual fee. You may also be charged a management fee by the adviser, which may be fixed or a percentage of the investment amount under management.

For more information about offshore bonds, including the benefits they offer and guidance on how to spot if you are being ripped off, please read our Offshore Investment Bonds article.

Expat investments: Pensions and QROPS

A pension scheme is a tax efficient savings plan which often forms a fundamental part of an investment portfolio and are designed to provide an income for an individual in later life.

Pensions themselves come in a number of forms and may be managed by an employer or the investor themselves. For expats and those with large UK pensions there is the additional option of a QROPS (Qualifying Recognised Overseas Pension Scheme) which is a wrapper that enables a non-resident to transfer a UK pension out of the UK and take advantage of a number of benefits. In recent years the overall benefits of a QROPS have diminished, although they can still provide a very beneficial investment option.

QROPS have also attracted negative press in recent years due to the behaviour of unregulated advisers, but they should never be discounted as a viable option, particularly if you do not intend to return to the UK.

We’ve created a detailed overview which looks at all aspects of QROPS, including the QROPS fees and charges as well as the QROPS transfer process itself.

Structured notes

A structured note investment is a fixed term, normally around 4 to 6 years, product normally sold by investment banks and is generally not available on the high street. It is made up of two or more derivatives (such as stocks, shares and indexes, eg. the FTSE100) and can pay money during the term while also provides a payment at the end of the fixed period of up to 100%.

The amount of money paid out by a structured note will depend on the conditions offered at the start of the fixed term that are related directly to the lowest performing derivative. During the life of the structured note, there will be regular reviews at which point the performance of each derivative will be reviewed and if the lowest performing derivative is outperforming a specific measure (eg. 5% above the original value) then it will pay out.

At the end of the fixed term, if the lowest performing derivative is above a conditional marker (for example 80% of the original value) the investor will normally receive the full investment back.

Due to the complex nature of structured notes, they are normally only available for sophisticated or high-net worth investors, however financial advisers typically fall into one of these categories and therefore can offer them to their clients, providing they fully explain and ensure that the investor fully understands the structured note, including the risks and benefits.

It is uncommon for an entire investment portfolio to be constructed by structured notes and will normally account for around 10% of a total investment.

We have written a comprehensive guide to structured note investments, with specific reference to how they are offered to expats, including examples, explanations of fees, an overview of the risks and benefits and why you should always invest cautiously if they are being offered.

Expat investments: Property

Much the same as a pension scheme, investment in property is a common feature within an investment portfolio. Often for expats, this may include the primary residence as well as additional properties which are used to generate a regular rental income.

Until recently, expats were also able to take advantage of rising house prices by selling UK based property without attracting UK capital gains tax. However, in April 2015, this loophole was closed and any sale of a UK property is now subject to capital gains tax.

Despite this change in tax rules, ever increasing house prices make the UK a very attractive proposition for buying property for both long term and short term returns.

For expats, it can be difficult to secure a mortgage in the UK for additional properties and, while it is possible through specific mortgage advisers, it is recommended that only those who can afford to buy a property outright should do so.

Other fees and costs which should be taken into consideration when considering investing in UK property include management fees of any agency which is required to manage the tenants and maintenance and also income tax on any rental income.

It is important to remember that income arising from a rental income from property in the UK will be subject to UK income tax which will require a tax return to be completed, and potentially tax in the country of residence. In the UK, the personal tax allowance still applies for non-residents, but you will still need to complete a tax return which declares any income received.

Investment platforms

An investment platform is an online service the enables individuals and advisers to invest in financial products. Operated by a variety of financial institutions, they can typically offer a wider range of investment options than would normally be available for the average investor. Due to this, it is always sensible to seek independent advice before making any investment decisions to ensure that you do not expose yourself to unnecessary risk.

Even through investment platforms normally charge administration fees, the costs of managing investments through a platform can normally be reduced, while also increasing the flexibility of your investment options.

Due to the complexities around tax and financial regulations, expats and non-residents will have limited options when it comes to choosing between investment platforms and by working with an adviser you are likely to increase the options available.

Read our article which explains what is an investment platform for more information.

Expat investments: Alternative investments

Aside from traditional investments, you can also seek what is known as an alternative investment.

Alternative investments have risen in popularity in recent years, but the underlying principles will often be the same. For example, an investment in wine would typically involve the purchase of a number of bottles of wine which are expected to appreciate in value over time. The wine will typically be stored in cellars and not be readily accessible.

Due to the nature of the investment, alternative investments attract a significant amount of negative publicity and potentially expose the investor to fraudulent activities. Often the investment opportunity will sound too good to be true – and often may well be. It is vital that before making any decisions that full independent analysis of any opportunity is sought to ensure that you are protected from unscrupulous, unregulated activities.

We have already created a full overview of alternative investment options available to expats, but as always, this should not be relied upon to make a decision and you should always seek independent advice.

Investing through an international bank

Most international banks now offer wealth management services for expats seeking investment options. Depending on the level of capital you have to invest, the services offered vary greatly.

One of the key factors when researching which international banks to consider for your investment options is the restricted nature of the advice on offer. Most people consider wealth managers and financial advisers to be “independent”, however, to be considered independent and adviser must be able to choose from the whole of the market.

Most wealth managers and advisers who work for international banks, unless stated otherwise, are restricted to the products available from the bank, which means you may be missing out on your most suitable investment option(s).

Request free consultation with an independent financial adviser

If you are interested in understanding more about expat investments, including your full range of options as an expat, enter your details via the form to request a free consultation with an independent financial adviser.

All advisers in our network have extensive experience of providing sound investment advice to expats around the world, and also in the UK.

At no point will you be obligated to take their advice, but you can be confident they are fully independent and able to offer options which cover the whole of the available market. This will enable you to make an informed decision about expat investments.